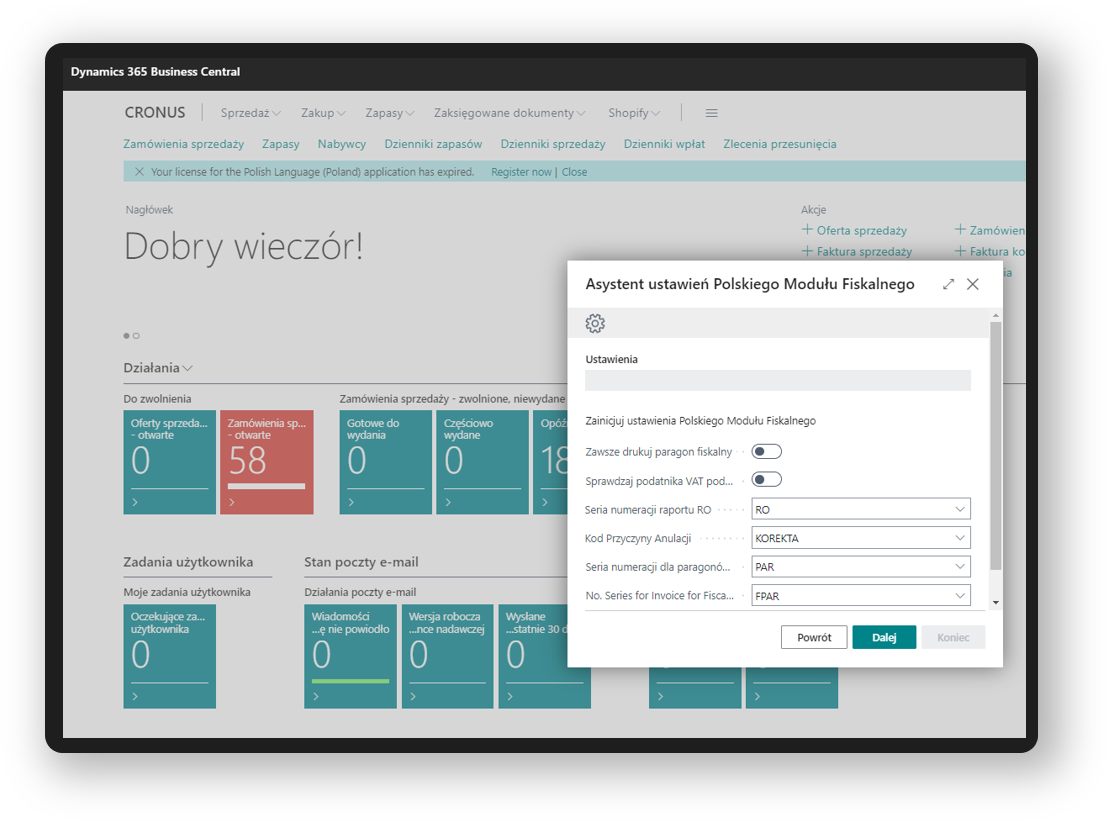

Management of fiscal receipts

in Dynamics 365 Business Central

We present our solution that allows you to handle the functionality of fiscal receipts in a Polish localization. Our solution is compatible with the Polish localization module in terms of proper records in the VAT register and generation of the Standard Audit File for Tax (JPK).

- Program for remote printing of a fiscal receipt

- Fiscalization and printing of a fiscal receipt (including an advance payment receipt)

- Cancellation of fiscal receipt

- Generating a periodic report summarizing fiscal sales

- Fiscal sales records in JPK VAT

Operational diagram

Benefits and functionalities

FAQ

-

What is the fiscal module?

The fiscal module is our proprietary solution in the Microsoft Dynamics 365 Business Central system, which is used to record financial transactions, generate fiscal receipts while ensuring compliance with tax regulations.

-

What are the main functions of the fiscal receipt application?

The basic functions of the fiscal module include:

o Recording sales and service transactions.

o Generating fiscal receipts with required data, such as transaction number, date, price, VAT, etc.

o Storing transaction data for the purposes of possible tax audits.

o Securing the sales process against manipulation and forgery. -

What are the benefits of using the fiscal module?

The benefits of using the fiscal module include:

o Facilitate tax compliance.

o Securing the sales process against irregularities.

o Accurate transaction recording and accounting.

o Increasing customer confidence by issuing fiscal receipts. -

What is worth knowing about operating fiscal printers?

According to polish law who sell to natural persons not conducting business activity and flat-rate farmers are obliged to keep records of turnover and amounts of tax due using cash registers.

A cash register is a device that can operate fully independently. The process of registering sales at the cash register involves entering product (or service) codes directly from the keyboard or using a scanner. Before sales start, the names of the products/services sold are programmed into the cash register's memory. The recording printer, in turn, is a fiscal addition to the computer sales system. In this case, the sale is carried out using software on the computer, and the printer only prints the ready receipt while recording the transaction in its memory. This means that sales data are generated and stored by a computer program, and the fiscal printer is only used to print the receipt.

A receipt is an important commercial document used to record retail sales. Its issuance confirms the purchase transaction and is generated by sellers using cash registers or fiscal printers. The receipt contains basic information about the product price, taxes charged and the seller's identification data. Unlike an invoice, an issued receipt does not affect entries in VAT registers. It serves mainly as proof of purchase and allows the customer to obtain documentation regarding the transaction.

-

How to see the application DEMO?

To make an appointment for DEMO presentations

please complete the contact form

or use direct contact:

E-mail: dynamics@eip.pl

Phone: +48 533 003 630

Contact

We will contact you within 24 hours of sending the form